|

Monday, September 30, 2019

EzineArticles Alert: Business-Networking

Important update: Changes to AdMob policies have now launched

|

Saturday, September 28, 2019

A friend wants you to like a Page on Facebook

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tuesday, September 24, 2019

NEW ALERT

| You don't want to miss this. |

|

Sunday, September 22, 2019

A friend wants you to like a Page on Facebook

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Saturday, September 21, 2019

Tips and Tricks Latest Post

Tips and Tricks Latest Post |

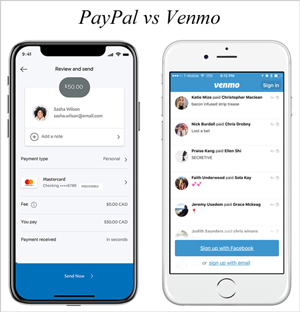

| Posted: 21 Sep 2019 06:16 AM PDT PayPal and Venmo are both payment platforms that can be used to accept money from friends, family, employers or customers. They are both leading digital wallets and while they share common features, a number of factors set the two companies apart. In fact, if you’ve noticed the similarity of these payment giants, you wouldn’t be surprised to learn that PayPal actually owns Venmo. In this article, we will look at what the difference is between PayPal and Venmo and why certain people choose one platform over another.

What is the Main Difference Between PayPal and Venmo?While the majority of online business owners have heard of or even used PayPal, many may have not yet heard of Venmo. The reason for this is that Venmo is mainly used by the everyday users rather than business owners. In fact, you cannot currently accept Venmo payments for goods or services unless you are already using Braintree or PayPal and have been approved. This differs in the way that any merchant with a PayPal Business account can use PayPal’s API, or a plugin such as our very own Simple PayPal Shopping Cart to accept payments for goods or services online. Venmo in fact is even partly a social media feed, where a user can make a transaction public so that all Venmo users or just their contacts can see the transaction. Due to Venmo being a trendy way to make a payment to an acquaintance, friend or family member, there is no surprise that millennial’s are the largest group of users. While there are some businesses that have jumped on board to accept Venmo, the majority of companies still prefer their sister company PayPal. While both PayPal and Venmo are digital wallets, the main difference is that PayPal is widely used by small and large scale businesses, whereas Venmo the majority of the time is used for transactions between friends. With PayPal you can look at as the professional approach, whereas Venmo allows you to add personal touches to a transaction you send.

Comparing PayPal and Venmo – Video TutorialHow Does Venmo Work?Similar to PayPal, Venmo allows you to link a bank account and credit cards as a means of payment. If you choose to use your Venmo balance or your bank account to send money, you can expect to pay no fee while using your credit card will incur a 3% transaction fee. Just like PayPal, once someone pays you from their Venmo account, the money will appear in your app/dashboard which you can then send to your bank account or allow to sit. Venmo unlike PayPal was designed for smaller transactions such as splitting a dinner bill among friends. For this reason, the Venmo developers have invested much more time into setting up a phone application that is smooth and simple for their users. Once you have the application on your phone, you can add payment contacts by linking your Facebook account, entering their name or username or directly scanning their Venmo QR code if they have their application up on their mobile device. Venmo is more of a social transacting platform as you can make transaction descriptions public if you wish to. Many people use this as a way to interact with others using the platform. While Venmo is popular among the younger generation for fixing up debt to friends, in the larger scheme PayPal is still the most popular mainly due to the buyers protection they offer. The buyers protection gives a buyer some come-back if the seller does not provide the goods or service within a reasonable time frame. On the other hand Venmo does not.

Can I Have a PayPal and Venmo Account?If you’re wondering if you can run a PayPal and Venmo account at the same time, you’ll be happy to know that the answer is yes. This is especially important for business owners who wish to use PayPal for their business transactions and Venmo for their personal transactions. This allows one to separate their personal and private life. Separating the accounts for their uses makes the most sense. If you have customers flowing onto your website to buy physical or digital items, it makes the most sense to use PayPal to accept their payment. If you are out for dinner and you need a neat way of evenly splitting the bill, if you live within the US Venmo will be your go to application. Summing Up PayPal Versus VenmoIf you are an everyday US citizen looking for a digital wallet, Venmo may work out a fee free way of transacting money with your family and friends. If you are a business owner on the other-hand, in our opinion PayPal or Stripe are still the best eCommerce solutions which you can read more about here. You can look at PayPal as the big sister to Venmo. PayPal was first established in 1998 while Venmo didn’t hit the eCommerce world until 2009. This gives PayPal many more years of development and integration opposed to Venmo. For this reason, they have a larger pull in the eCommerce world with a greater following of general personal account holders and business account holders. Last year in 2018, Venmo accounted for $19 billion in payments while PayPal accounted for hundreds of billions of dollars in transactions. While Venmo may always remain the smaller company, under PayPal’s belt Venmo is sure to become increasingly popular and feature rich in the coming years. The post PayPal vs Venmo appeared first on Tips and Tricks HQ. |

| You are subscribed to email updates from Tips and Tricks HQ. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Friday, September 20, 2019

iPhone 11 Pro and iPhone 11 are here.

![]()

All-new triple-camera system. 5.8‑inch or 6.5‑inch Super Retina XDR display.2 The fastest chip in a smartphone. Up to 5 more hours of battery life.3 Water resistant to 4 meters for up to 30 minutes.4

All-new dual-camera system. 6.1‑inch Liquid Retina HD display.2 The fastest chip in a smartphone. All-day battery life.3 Water resistant to 2 meters for up to 30 minutes.4

Trade in and save

Get up to $600 credit when you trade in your current iPhone.5 You can trade in Android smartphones for credit, too.

Choose your payment option

Choose low monthly payments with 0% APR, or pay in full. You'll get 3% Daily Cash if you use your Apple Card.

Get the latest iPhone every year

The iPhone Upgrade Program gets you the latest iPhone every year, low monthly payments, and AppleCare+ coverage.

Keep your carrier and number

We can help you keep your current number and rate plan and activate your new iPhone in the store.

Transfer data fast

Let us quickly move all your data from your old device to your new one.

Protect with AppleCare+

Get hands-on service and support from Apple experts who know iPhone best.

Privacy matters

We protect your information, from carrier details to the personal data stored on your phone, at every stage.

Get help buying

Have a question? Chat online or call a Specialist at 1-800-MY-APPLE.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Shop Online

- Find a Store

- 1-800-MY-APPLE

- Get the Apple Store App

- Trade In: Trade‑in values vary. iPhone 11 and iPhone 11 Pro promotional pricing is after trade‑in of iPhone 8 Plus and iPhone X in good condition. Additional trade‑in values require purchase of a new iPhone, subject to availability and limits. Must be at least 18. Apple or its trade‑in partners reserve the right to refuse or limit any Trade In transaction for any reason. In‑store trade‑in requires presentation of a valid, government-issued photo ID (local law may require saving this information). Sales tax may be assessed on full value of new iPhone. Additional terms from Apple or Apple's trade‑in partners may apply. Monthly pricing: Available to qualified customers and requires 0% APR, 24‑month installment loan with Citizens One, and iPhone activation with AT&T, Sprint, T‑Mobile, or Verizon. Full terms apply.

- The display has rounded corners. When measured as a rectangle, the screen is 6.06 inches (iPhone 11), 5.85 inches (iPhone 11 Pro), or 6.46 inches (iPhone 11 Pro Max) diagonally. Actual viewable area is less.

- All battery claims depend on network configuration and many other factors; actual results will vary. Battery has limited recharge cycles and may eventually need to be replaced by Apple service provider. Battery life and charge cycles vary by use and settings. See apple.com/batteries and apple.com/iphone/battery.html for more information.

- iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max are splash, water, and dust resistant and were tested under controlled laboratory conditions; iPhone 11 Pro and iPhone 11 Pro Max have a rating of IP68 under IEC standard 60529 (maximum depth of 4 meters up to 30 minutes); and iPhone 11 has a rating of IP68 under IEC standard 60529 (maximum depth of 2 meters up to 30 minutes). Splash, water, and dust resistance are not permanent conditions and resistance might decrease as a result of normal wear. Do not attempt to charge a wet iPhone; refer to the user guide for cleaning and drying instructions. Liquid damage not covered under warranty.

- Trade-in values may vary, and are based on the condition and model of your trade‑in device. Additional trade‑in values require purchase of a new iPhone, subject to availability and limits. Must be at least 18. Offer may not be available in all stores and not all devices are eligible for credit. Apple or its trade-in partners reserve the right to refuse or limit any Trade In transaction for any reason. In‑store trade‑in requires presentation of a valid, government‑issued photo ID (local law may require saving this information). Sales tax may be assessed on full value of new iPhone. Value of your current device may be applied toward purchase of a new Apple device. Additional terms from Apple or Apple's trade‑in partners may apply. See apple.com/shop/trade-in for more information.

- $4.99/month after free trial. One subscription per Family Sharing group. Offer good for 3 months after eligible device activation, starting November 1, 2019. Plan automatically renews until cancelled. Restrictions and other terms apply.

TM and © 2019 Apple Inc. One Apple Park Way, MS 96-DM, Cupertino, CA 95014.

All Rights Reserved|Privacy Policy|My Apple ID

If you prefer not to receive commercial email from Apple, or if you've changed your email address, please click here.